金色新闻汇2022-07-14 16:38:58

There are a number of layer two (L2) scaling solutions that will launch native tokens.

There are also apps on these L2s that will launch their own tokens as well.

It may be possible to receive two airdrops later for the price of performing one on-chain activity now.

Accordingly, this Bankless tactic will show you how you may “double up” on future airdrops while early adopting Layer 2 tech.

· Goal: Learn about doubling up airdrops

· Skill: Intermediate

· Effort: 30 minutes

· ROI: Earning future airdrops

有很多2层(L2)扩容方案将来会发行原生代币。

还有很多运行在这些L2上的app将来也会发行它们的专属代币。

所以,你现在也许有机会仅需执行一次链上活动,用这一次的成本换取之后的两波空投。

而这篇Bankless策略会向你具体展示,提前交互L2技术也许会让你在未来收获“双倍”空投。

· 目标:了解如何让空投“翻倍”

· 技能要求:中等

· 所需努力时长:30分钟

· 投资收益:赚取未来空投

Where to look for double up opportunities

到哪里寻找双倍的空投机会

Hunting for airdrops is one part pastime, one part on-chain gig work for the modern degen. Right now, the frontiers of web3 are where the best potential opportunities to efficiently “double up” on airdrops can be found.

By that, I mean performing one activity to get in line for two distinct future token distributions.

To find these opportunities, here’s where you start:

1. Find a promising Ethereum L2 that hasn’t released a token yet — or in the case of Optimism, a project that plans further phases of token airdrops in the future.

2. Find and use apps on these L2s that also haven’t released native tokens yet.

Keep in mind that there are no guarantees with this strategy. It could lead you to trying out L2s or apps that never actually release their own tokens!

This early on in the lifespan of the blooming L2 ecosystem, there will be more than a few “double dip” airdrops that come to pass. Positioning yourself now will make all the difference later.

Accordingly, if you’re interested, consider trying some token-less apps on candidate L2s so that if any of those projects + rollups do eventually conduct retro token launches to early users, you’ll be among those users.

对于时髦的degen来说,寻找空投既是消遣又是工作。现在,能高效发现“双倍”空投最佳潜在机会的地方要属web3的前沿领域。

关于双倍空投,我指的是执行一次链上活动,然后等待收获两波不同的未来代币分发。

想要找到这些机会,你需要这么做:

1.找到一个还没发行但有望发行代币的以太坊L2——或者像Optimism那样的计划将来会多轮空投代币的项目。

2.找到这些L2上面还没发行原生代币的app,并应用这些app。

记住,这个策略并不保证一定会成功,但可以引导你去尝试那些还没真正发行过专属代币的L2或app!

蓬勃发展的L2生态早期阶段会上演一些“二次”空投。现在准备好开始埋伏,将来就会大有不同。

所以,如果你对此感兴趣,考虑一下试试那些候选L2上的无代币app,如果这些项目+rollup中最终能有一个对早期用户进行代币追溯发行,你就是其中一员。

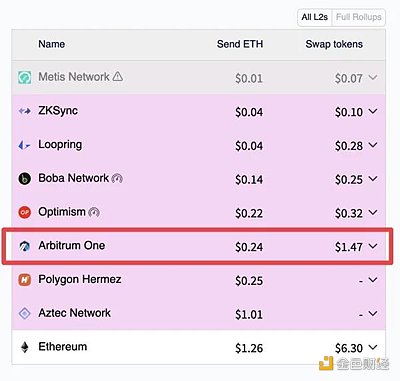

As for which L2s to specifically target: Optimism, zkSync, and Arbitrum appear to be low-hanging fruit.

For instance, we already know Optimism is holding multiple additional rounds of OP airdrops going forward, and the zkSync project has confirmed its own token plans. Arbitrum’s team has been mum on token talk, but it seems all but poised to release a token for community coordination.

That leaves us with having to pick out specific apps that are presently token-less that can be used on these L2s. I’ll help you cut to the chase here by showing you some projects that fit that bill…

至于要特别关注哪些L2?Optisism、zkSync和Arbitrum似乎是最容易让我们实现目标的L2。

例如,我们已经知道Optimism正在持续进行多轮额外的OP空投,zkSync项目也已确认其专属代币发行计划。虽然Arbitrum团队对是否会发行代币没有表态,但为了促进社区协作,似乎也已做好了发行代币的准备。

这就要求我们必须挑选特定的app,也就是那些目前还没有发行代币的可应用于L2上的app。我们现在来切入主题,一起去看几个符合要求的项目……

First, head for the bridges

首先,去看桥

There are many L2-centric bridge projects out there that haven’t launched tokens yet.

Hop unveiled its HOP earlier this year. it’s probable that in the months ahead, multiple bridges perform retro-distributions in bids to keep up liquidity-wise.

Some such bridges that may eventually release their own tokens that you might try include:

· Bungee — supports Arbitrum, Optimism, and other L1 EVMs

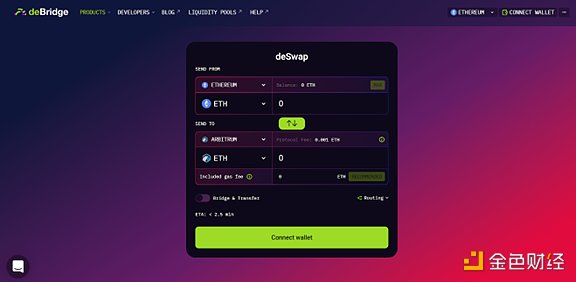

· deBridge — supports Arbitrum and other L1 EVMs

· Mosaic by Composable Finance — supports Arbitrum and other L1 EVMs

· Orbiter Finance — supports zkSync, Arbitrum, Optimism, and other L1 EVMs

· transferto.xzy by LI.FI — supports Arbitrum, Optimism, and other L1 EVMs

Some of these projects, like Orbiter Finance, may not be fully audited yet, so use with caution — and not with your full crypto stack, of course.

However, these bridges present some of the most obvious potential “double up” airdrop candidates right now.

目前有很多L2中心化的桥项目尚未发行代币。

Hop在今年早些时候推出了自己的HOP代币。或许在接下来的几个月,很多桥会追溯分发代币,以期保持明智的流动性。

诸如此类的桥最终也许会发行它们自己的代币,你或许可以试试:

· Bungee——支持Arbitrum、Optimism及其他兼容EVM的 L1

· deBridge——支持Arbitrum及其他兼容EVM的 L1 、

· Composable Finance的Mosaic——支持Arbtrum及其他兼容EVM的 L1

· Orbiter Finance——支持zkSync、Arbitrum、Optimism及其他兼容EVM的 L1

· LI.Fi的transferto.xzy——支持Arbitrum、Optimism及其他兼容EVM的 L1

其中有些项目还不没有得到完全审计,比如Orbiter Finance,所以要谨慎使用——当然,也不要把你的加密货币一揽子全放进去。

无论如何,这些桥目前提供了最明显的潜在“双倍”空投机会。

Other L2 projects without tokens

其他无代币的L2项目

Argent

Argent

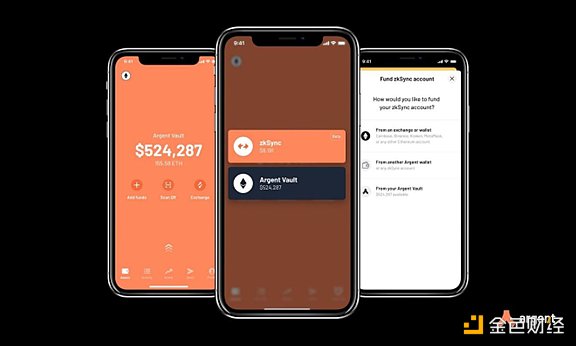

Argent is a mobile social recovery wallet that supports Ethereum and the zkSync L2. On the zkSync side of things, Argent offers curated L2 DeFi investment opportunities across Aave, Lido, and Yearn.

If Argent ever launches a retro token distribution, having used these integrations will have prepared you for that and presumably the eventual zkSync token.

♟️ Potential strategies:

· Use zkSync on Argent to lend DAI or USDC on Aave

· Use zkSync on Argent to stake ETH on Lido

· Use zkSync on Argent to invest ETH, DAI, USDC, or WBTC into Yearn

Argent是一款社交恢复移动钱包,支持以太坊和zkSync L2。从zkSync层面来说,Argent提供了遍及Aave、Lido及Yearn的L2 DeFi投资机会。

如果Argent要推出追溯代币分发,那么应用这些集成可以为你助力,也许能让你最终拿到zkSync代币。

♟️ 潜在策略:

· 在Argent上应用zkSync,在Aave上借出DAI或USDC

· 在Argent上应用zkSync,在Lido上质押ETH

· 在Argent上应用zkSync,向Yearn投入ETH、DAI、USDC或WBTC

Cozy

Cozy

Cozy Finance is an open-source, insurance-like protocol that allows people to create automated DeFi protection markets.

Earlier this year the project added support for Arbitrum, and remains token-less. It remains in the realm of possibility that supplying, borrowing, or investing on Cozy might affect your chances for COZY + ARBI tokens down the road.

♟️ Potential strategies:

· Use the Protected Investing feature on Cozy

· Deposit funds to provide protection on Cozy

· Borrow funds on Cozy

(Note: Cozy is not available to U.S. users ??)

Cozy Finance是一个开源的、类保险的协议,允许用户创建自动化DeFi保护市场。

今年早些时候,该项目新增了对Arbitrum的支持,还是没有发行代币。它仍处于一个可能性的范围,你可以在Cozy上借贷或投资,进而有可能影响你获得COZY + ARBI代币的机会。

♟️ 潜在策略:

· 应用Cozy的Protected Investing功能

· 在Cozy上存储资金提供保护

· 在Cozy上借出资金

(注意:Cozy目前不对美国用户开放使用)

DeFi Saver

DeFi Saver

DeFi Saver is an advanced DeFi management platform that’s like a personal on-chain command center.

The token-less project even lets you simulate popular DeFi actions, so you know how transactions will work beforehand. Earlier this year the project rolled out support for Arbitrum and Optimism, and while its team has made no indication that it has plans to airdrop a token to its L2 users, that possibility remains in play.

♟️ Potential strategies:

· Make a swap through DeFi Saver while on Arbitrum or Optimism

· Use the Aave integration on DeFi Saver while on Arbitrum or Optimism

DeFi Saver是一个先进的DeFi管理平台,类似一个个人的链上控制中心。

这个无代币的项目甚至能让你模拟流行的DeFi行为,这样你就会提前知道交易是如何进行的。今年早些时候,该项目推出对Arbitrum和Optimism的支持,但该项目团队并没有明确指出有针对其L2用户的空投计划,空投的可能性仍然未知。

♟️ 潜在策略:

· 在Arbitrum或Optimism上通过DeFi Saver进行一次交易

· 在Arbitrum或Optimism上应用DeFi Saver上集成的Aave

Quixotic

Quixotic

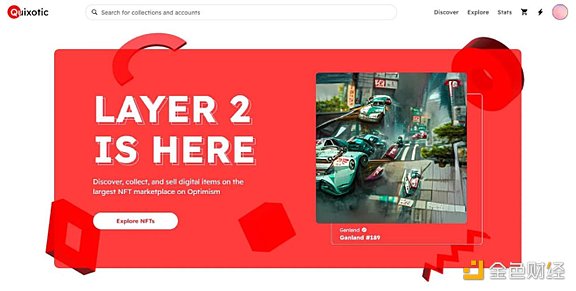

Quixotic is currently the largest NFT marketplace on Optimism.

It may one day opt to launch a token like other NFT marketplaces, e.g. SuperRare and RARE. Accordingly, buying and selling NFTs on the platform might later help you “double up” on a Quixotic token (if it actually happens) and further OP airdrop phases.

♟️ Potential strategies:

· Buy NFTs on Quixotic

· Sell NFTs on Quixotic

Quixotic是当前Optimism上最大的NFT市场

也许某天它会像其他NFT市场那样选择发行代币,如SuperRare及RARE。所以,在这个平台上买卖NFT也许会帮助你在将来获得“双倍”的Quixotic代币(如果确会发行此代币)以及在后续的OP空投中收获更多。

♟️ 潜在策略:

· 在Quixotic上买入NFT

· 在Quixotic上卖出NFT

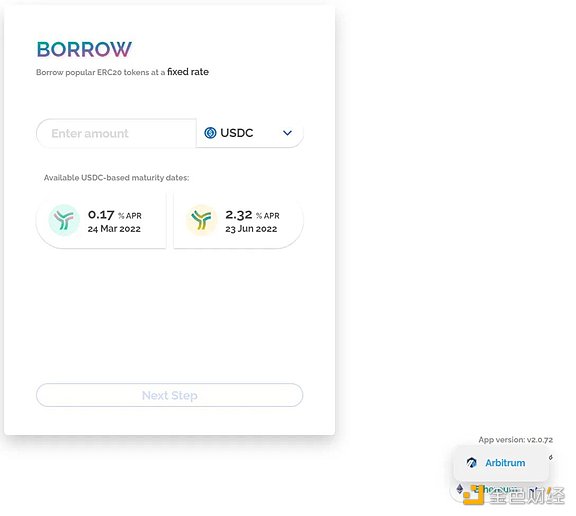

Yield Protocol

Yield Protocol

Yield Protocol is a fixed-rate borrowing and lending protocol that activated support for Arbitrum in March 2022.

The project’s FAQ explains that “long-term we expect Yield Protocol to be community-owned,” so it seems a token is indeed coming somewhere down the road. Whether that token would come to fruition on Arbitrum over Ethereum remains to be seen, but nevertheless Yield Protocol’s a project to watch in the meantime.

♟️ Potential strategies:

· Lend on Yield Protocol’s Arbitrum deployment

· Borrow on Yield Protocol’s Arbitrum deployment

· Provide liquidity on Yield Protocol’s Arbitrum deployment

Yield Protocol是一个固定利率的借贷协议,今年3月份推出了对Arbitrum的支持。

该项目在其FAQ中解释说明了“从长期来看我们期望Yield Protocol为社区所有”这一言论,以此判断,似乎确有代币正在来的路上。但代币是否会在以太坊上的Arbitrum发行尚未可知,无论怎样,Yeild Protocol是你需要在此期间留心注意的项目。

♟️ 潜在策略:

· 在Yield Protocol的Arbitrum布署上贷款

· 在Yield Protocol的Arbitrum布署上借款

· 在Yield Protocol的Arbitrum布署上提供流动性

Conclusion

结论

It’s quite simple: Find promising L2s that are likely to perform retro distributions, use cool token-less apps on these L2s — and then sit back and wait.

Of course, things might not always be so simple -- you may have to participate in wider programs like The Arbitrum Odyssey (which is currently paused) to lock down a token allocation, for example.

其实非常简单:找到有望进行代币追溯分发的L2,在这些L2上应用表现突出的无代币app——然后,静等丰收。

当然,事情不会总是这么简单——也许你还必须参与一些范围更广的项目,比如Arbitrum Odyssey(目前处于暂停状态),以锁定代币分发。

It’s a low-risk, bear-ready speculative strategy that you can move on right now. But there are so many things we don’t know: how potential L2 token distributions will work, or which projects will unveil tokenomics, etc.

What we do know, though, is that most L2s will likely launch tokens. and some apps on these L2s will likely launch their own tokens, too.

Accordingly, a straightforward thing to do to position for these potential “double up” airdrop opportunities is to try as many candidate projects as you want and then see if you get any bites in the future.

这是一个低风险、在熊市中可行的投机策略,你现在就可以试试看。但是有太多是我们不知道的:潜在的L2代币发布将如何运作,究竟哪些项目将会推出代币,等等。

但我们知道的是,大多数L2有可能推出代币,这些L2上的一些app也有可能发行自己的专属代币。

所以,要埋伏这些潜在的“双倍”空投机会,最简单可行的办法就是尽可能多地尝试候选项目,想尝试多少就尝试多少,然后等着看将来你能收获多少。

Action steps

行动步骤

? Try token-less bridge projects on L2s

⛹ Try token-less DeFi and NFT projects on L2s

? Also check out our previous tactic How to value NFT fundamentals tactic if you missed it!

? 在L2上试用无代币的桥项目

⛹ 在L2上试用无代币的DeFi和NFT项目

? 点击查看我们之前的策略文章(如果你还没读过此文):How to value NFT fundamentals tactic

本文作者: William M. Peaster(Bankless撰稿人及Metaversal作者)

金色新闻汇 2022-07-14

上海刘磊律师 2022-07-14

链捕手 2022-07-14

老雅痞 2022-07-14

上海市经济和信息化委员会 2022-07-14

去中心化金融社区 2022-07-14

中国电子报 2022-07-14

老雅痞 2022-07-14

SparkDAO 2022-07-14

Odaily星球日报 2022-07-14